Words Wal Reid

“But what I didn’t realise was, that it wasn’t some of them, it wasn’t most of them, it’s ALL of them. None of them at a certain level pay tax.”

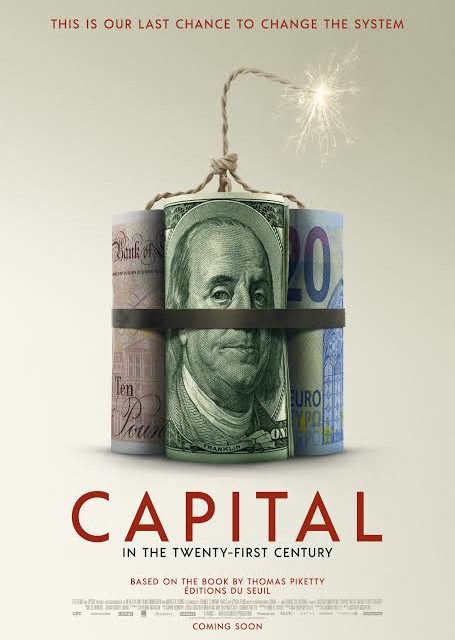

New Zealand documentary/filmmaker Justin Pemberton is charming on the phone. His latest film, Capital in the 21st Century, is a retrospective commentary on economist Thomas Piketty’s best-selling book of the same name. Its account of how concentrated wealth shapes the world was so compelling, that it went on to sell 1.5 million copies and was an unlikely bestseller in 2014. The movie explores the long-run effects of wealth inequality, and, is about to go global after the films’ recent screening at the New Zealand Film Festival.

Brought to the big screen by Pemberton, Piketty’s thesis is crisply and engagingly presented in a documentary purposefully light on graphs and numbers, and heavy on top-notch talking heads (Nobel laureate Joseph Stiglitz, the Financial Times’ Gillian Tett, who he says, “was one the few people who picked the last global financial crisis”), visuals of the rich and famous, and stylised historical recreations.

Wal Reid caught up with the dynamic documentary filmmaker. His movies Richie McCaw: Chasing Great, about the All Black legend, or intelligence sharing I Spy (with My 5 Eyes), has given the Documentary genre credibility and relevance from this part of the world. He has scooped numerous awards, both here and overseas, even an Emmy nomination for his unrelenting work in the industry. Also, interesting to note, is his unique auteur/musician relationship with musician Anika Moa, who, has also composed the soundtracks for five of Pemberton’s films.

How’s the PR tour going for the film?

It’s only New Zealand at this point, overseas is coming. It’s really good training wheels isn’t it? I think New Zealand always is. (laughter) Capital was almost very subtly meant to be a sci-fi film. It was about time travel. It was about going from the 1700’s to the near future. I love time travel and I love the future.

What made you get involved with this project?

I knew about the book, because I think it surprised everyone when it went to number one on the New York Times best seller list. I’d already done something on ‘inequality’ with New Zealand Television and Nigel Latta, way back in 2011, and I’d read a bit about it, so, I was interested to see what Thomas Piketty’s take was and got a copy of the book. Obviously for me straight away, it was the ‘time horizon’, he spans hundreds of years. People said, “Look what’s happened since the War”, and he goes back right before the French Revolution. But also, it was surprising, his book is an economic textbook. It wasn’t an easy read, and, it was written for people who were economists who are either studying at a tertiary level economics, or, are already trained. I think Thomas himself became interested in the fact, that so many people wanted to connect into his story, so, he was motivated to make a film based on that. New Zealand producer Matthew Metcalfe got in touch with him and pitched it. When I heard about Matthew talking to Thomas I went, “Oh, who’s going to make this?”, I really wanted to do it, so Matthew said, “Start writing it”, so, I did, on spec. It was sent to Thomas and he liked it.

All of your movies are ‘personal journeys’, have you discovered things that have blown your mind, making this film?

I had only read the book. It was something I’d been thinking about for a long time, so it wasn’t really new information in many ways. What it’s done has made me see even more, if that makes sense. Once you start looking, you start noticing things, you start seeing more, and more, and more. The whole thing about tax havens and things like that, I kind of thought, “Well, these big companies are not paying tax”. A lot of them, but what I didn’t realise was that it wasn’t some of them, it wasn’t most of them, it’s ALL of them. None of them at a certain level pay tax. I mean they pay a small, small amount. For example, in the film it talks about how Facebook is paying less UK tax than your average teacher, because of the way it gets shifted around the world, but it all ends up in a tax haven where none of it is taxed. You can’t dodge it completely, but this concept of the people at the top paying nothing, was worse than I thought. You need a certain amount of money to even be able to do that, it isn’t cheap, you need to have these structures and shell companies set up in shadow places that allow you to move everything, because it’s not illegal in that sense.

Do you risk being ostracised by Finance commentators?

I think it’s really interesting, if you check out the Financial Times in just the last week, they have absolutely everything that we’re talking about in the film. They’ve talked about how Capitalism needs a rework because it’s not working, and, how Democracy is failing because capital has influenced the narrative. I think that’s why things like climate change can’t be tackled, even though most of the world believe it. There’s so few sceptics now, even in America. I mean there’s another thing too, “How rich is rich?” That’s another thing I’ve noticed, everybody thinks, “The rich are richer”, even if you are rich. You can be very comfortably middle classed, and living a fabulous life and have a multi-million-dollar house, drive wealthy cars and taking lots of overseas holidays, but, you’re still saying, “Yes, but these people are the problem.”

With the New Zealand Reserve Bank Governor Adrian Orr, promoting consumerism, we are seeing a global trend of negative interest rates and introduced penalties, like in Australia, for having cash. Is this a trend that is happening globally?

I think that’s kind of another thing that’s going on. It’s all tied up but, this idea that to keep the ‘balls up in the air’, to be able to keep people consuming, to be able to keep growth coming. Yes, you need to almost penalise savings and promote debt. The rise of debt is something we look at. It arrived in the 90’s went absolutely berserk by the early 21st century, and that led to the global financial crisis, which, is when interest rates collapsed to be so low, and now, they can’t put them back up. In New Zealand in 2007/2008 people were paying 8.5% on their mortgages, that’s been ten years now of low interest. I would say that a lot of people, if you suddenly doubled your interest rate you’re paying now, that would be a problem. Then, what do you have, another real estate market collapse? Maybe people who don’t own houses would be really excited about it, because they’ve become so expensive. Why have they become so expensive? Because credit has become so cheap. Historically there have been a few ways out of it, either financial collapse or revolution.

What projects do you have now for consideration?

Well, it’s about funding (laughter). In New Zealand there’s a certain amount of public funding from the NZ Film Commission & NZ On Air. You have to be able to tick the boxes, it’s regulated capital in every sense, so it has to be a New Zealand story. There’s a story I’d love to tell that’s been on my mind for a while. It’s set in America and it’s about the future and I can’t see how I can get it funded just yet. Just getting there is an idea at the moment. And there’s another one that I’d like to make that’s kind of a hybrid between Capital and another film I made, 5 Eyes, so I’d like to go there. But I’m always interested in people. A person with an interesting story.